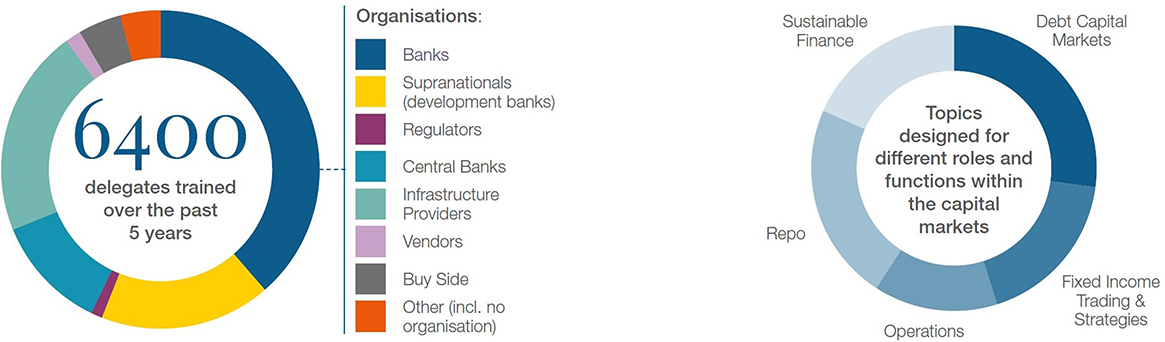

Subject Areas

We cover the following areas in financial markets

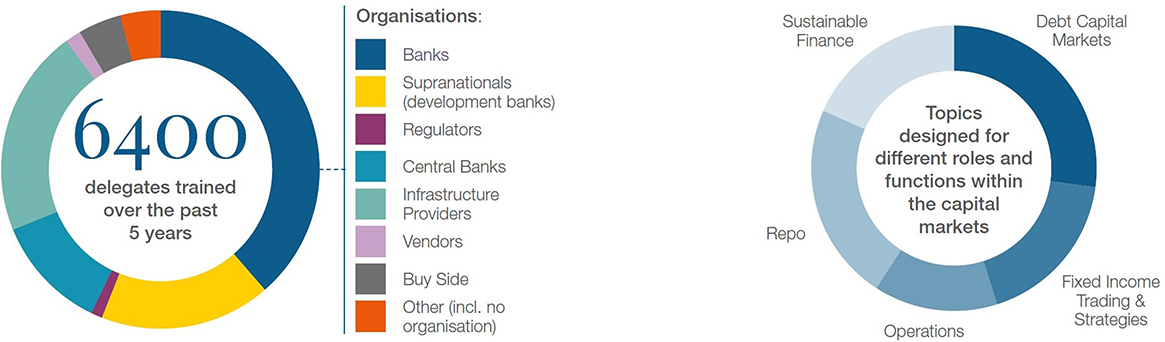

Clients and partners include:

LATEST COURSES

For over 50 years ICMA and its members have worked together to promote the development of the international capital and securities markets, pioneering the rules, principles and recommendations which have laid the foundations for their successful operation.

ICMA has around 620 members located in 68 jurisdictions drawn from both the sell and buy-side of the market.

Here are the key sections covering our work programmes, including contact details of ICMA staff responsible for each area.

ICMA also leads numerous other initiatives in sustainable finance. ICMA is at the forefront of the financial industry’s contribution to the development of sustainable finance and in the dialogue with the regulatory and policy community.

ICMA Education has been setting the standard of training excellence in the capital markets for almost five decades with courses covering everything from market fundamentals to latest developments and more.

FIND OUT MORE LINKEDIN DOWNLOAD THE BROCHURE

Find out about our latest announcements

Welcome to ICMA Education

Welcome to ICMA Education

Subject Areas

London, 8-10 May 2024

Classroom | Amsterdam, 13-17 May 2024

Classroom | Kuwait, 19-23 May 2024

Livestreamed, 28 May-4 June 2024

Classroom | London, 30-31 May 2024

Classroom | London, 3-4 June 2024

Livestreamed, 5-14 June 2024

Classroom, 5-6 June 2024

Livestreamed, 10-28 June 2024

Classroom | London, 13-14 June 2024

Livestreamed, 23 September-2 October 2024

Livestreamed, 23 September-1 October 2024

Classroom, 26-27 September 2024

Livestreamed, 14-22 October 2024

Livestreamed, 17-25 October 2024

Classroom | London, 4-6 November 2024

Classroom | London, 11-12 November 2024

Livestreamed, 12-20 November 2024

LATEST COURSES