ICMA publishes guide to repo markets: South Africa

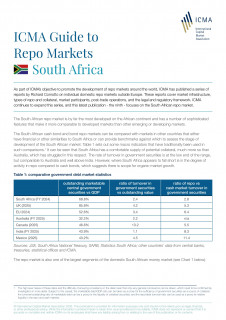

18 February 2026 ICMA’s guide provides an overview of the South African repo market, highlighting recent developments and describing the structure and operation of the market, its infrastructure, types of collateral and counterparties, and the legal and regulatory framework.

18 February 2026 ICMA’s guide provides an overview of the South African repo market, highlighting recent developments and describing the structure and operation of the market, its infrastructure, types of collateral and counterparties, and the legal and regulatory framework.

Download the ICMA guide to repo markets: South Africa

This report is the ninth in a series of guides on domestic repo markets, published as part of our ongoing commitment to supporting the development of repo markets globally. Previous guides covering China, Japan, Indonesia,

the Philippines, South Korea and Vietnam, were published in 2022 and 2023 (ICMA member login required), followed by Australia in 2024 (open access) and most recently India in 2025

(login required).

The South Africa guide, which is open access and available to all to download, was made possible through the Special Purpose Reserve Fund of Strate, in the interests of supporting market education and the alignment of South Africa’s financial markets to international best practice.

ICMA has played a significant role in promoting the international repo market since the 1990s. This includes the development of the Global Master Repurchase Agreement (GMRA), which has become the principal master agreement for cross-border repos globally, as well as for many domestic repo markets, supported by annually updated legal opinions in over 70 jurisdictions (view a full list of jurisdictions covered by the 2025 legal opinions update).

For more information contact: grcf@icmagroup.org