ICMA serves as Secretariat to the Green Bond Principles (GBP), the Social Bond Principles (SBP), the Sustainability Bond Guidelines (SBG) and the Sustainability-Linked Bond Principles (SLBP) - collectively known as "the Principles", providing support while advising on governance and other issues.

ICMA serves as Secretariat to the Green Bond Principles (GBP), the Social Bond Principles (SBP), the Sustainability Bond Guidelines (SBG) and the Sustainability-Linked Bond Principles (SLBP) - collectively known as "the Principles", providing support while advising on governance and other issues.

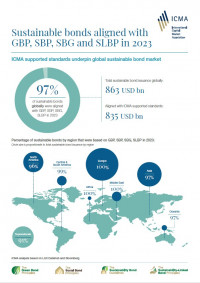

The total sustainable bond issuance globally in 2023 was USD 863 bn, 97% of which was aligned with the Principles (ICMA analysis based on LGX DataHub and Bloomberg).

The Principles are backed by a global market initiative bringing together all market participants and stakeholders from the private and official sectors. For more information, please contact us.

ICMA also leads numerous other initiatives in sustainable finance. ICMA is at the forefront of the financial industry’s contribution to the development of sustainable finance and in the dialogue with the regulatory and policy community.

You may also find our News page and LinkedIn page of interest.